tax shield formula excel

How to calculate tax shield due to depreciation. If feasible annual depreciation expense can be manually calculated by subtracting the.

Tax Shield Meaning Importance Calculation And More

A tax shield is an estimate of the reduction in taxable income that results from the use of specific tax-deductible expenses.

. Tax Shield Deduction x Tax Rate. Monday May 23 2022. A Tax shield is a necessary reduction in the taxable income of an individual or corporation achieved when a huge amount of expenses.

The interest tax shield can be calculated by multiplying the interest amount by the tax rate. The effect of a tax shield can be determined using a formula. It is utilized to boost cash flows and further raise a companys worth by decreasing tax expenses.

Interest Tax Shield Interest Expense. How to calculate after tax salvage valueCORRECTION. Tax Shield Tax Rate x Value.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Please do as follows. In the line for the initial cost.

In this video on Tax Shield we are going to learn what is tax shield. Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of. For depreciation an accelerated depreciation method will also allocate.

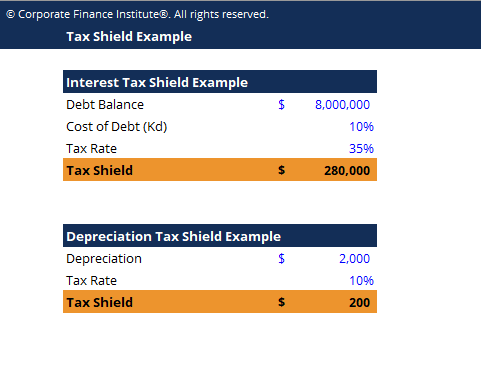

As such the shield is 8000000 x 10 x 35 280000. In the tax table right click the first data row and select Insert from the context menu to add a blank row. Of 2000 and the rate of tax is set at 10 the tax savings for the period is 200.

Depreciation Tax Shield Formula. Select the cell you will place the. As a cost of borrowing the borrower must make.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. How to calculate NPV. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

For more complex models wed recommend using the MIN. Depreciation Tax Shield Depreciation Expense Tax Rate. What is the Tax Shield Formula.

This is usually the deduction multiplied by the tax rate. Utilizing the following formula will make the calculation easier. A tax shield is a reduction in taxable income for an individual or corporation.

Tax shield formula excel. Interest Tax Shield Formula.

Using Apv A Better Tool For Valuing Operations

What Is The Depreciation Tax Shield The Ultimate Guide 2021

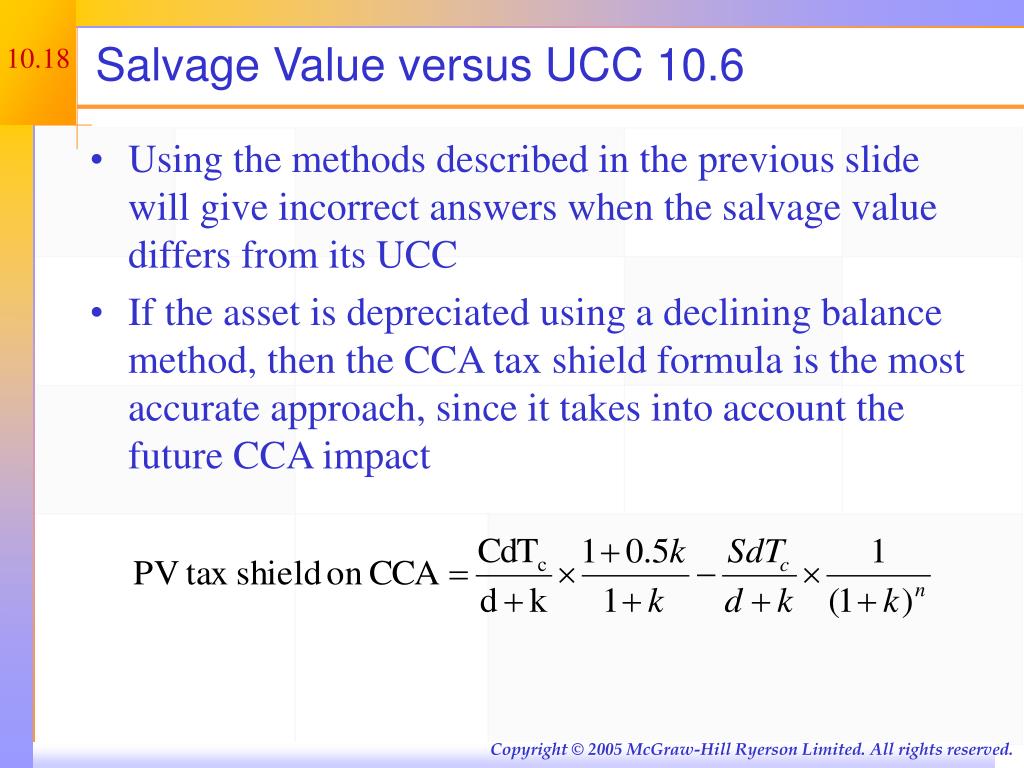

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Tax Shield Example Template Download Free Excel Template

Income Tax Formula Excel University

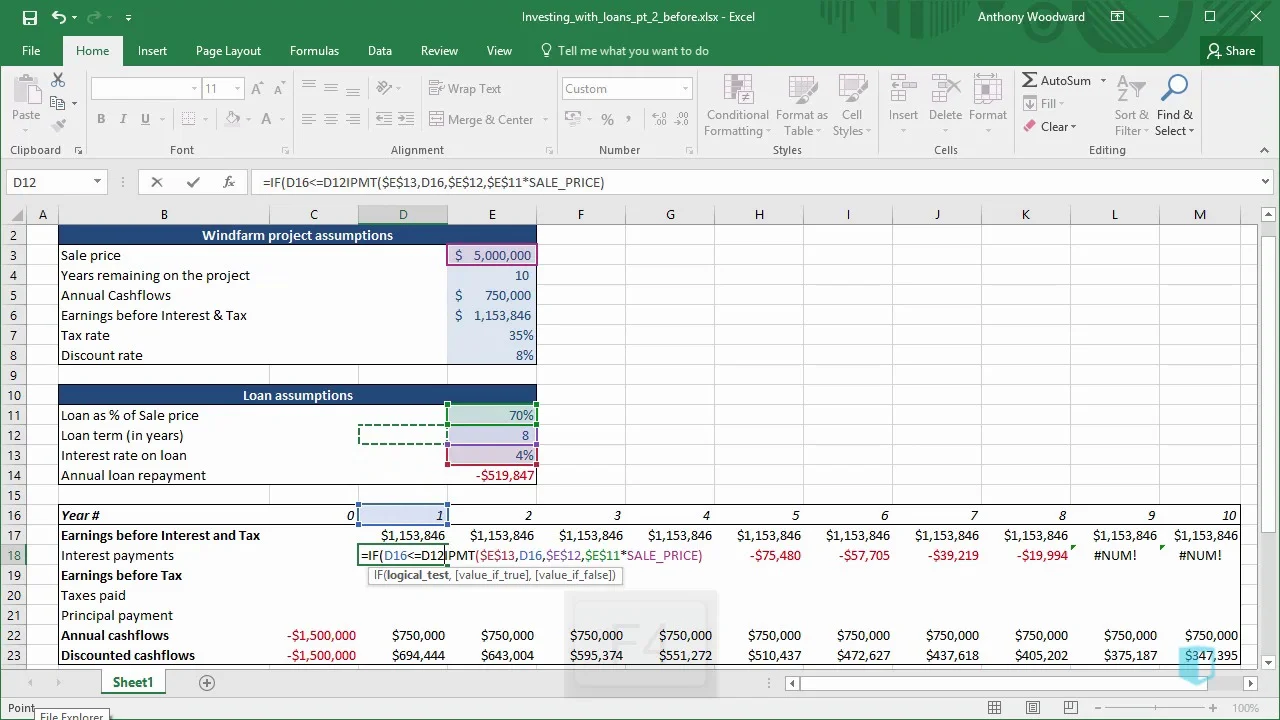

Investing With Loans Part 2 Online Excel Training Kubicle

Cima Spreadsheet Skills Debt Sculpting

Income Tax Formula Excel University

Ppt Making Capital Investment Decisions Powerpoint Presentation Free Download Id 3750664

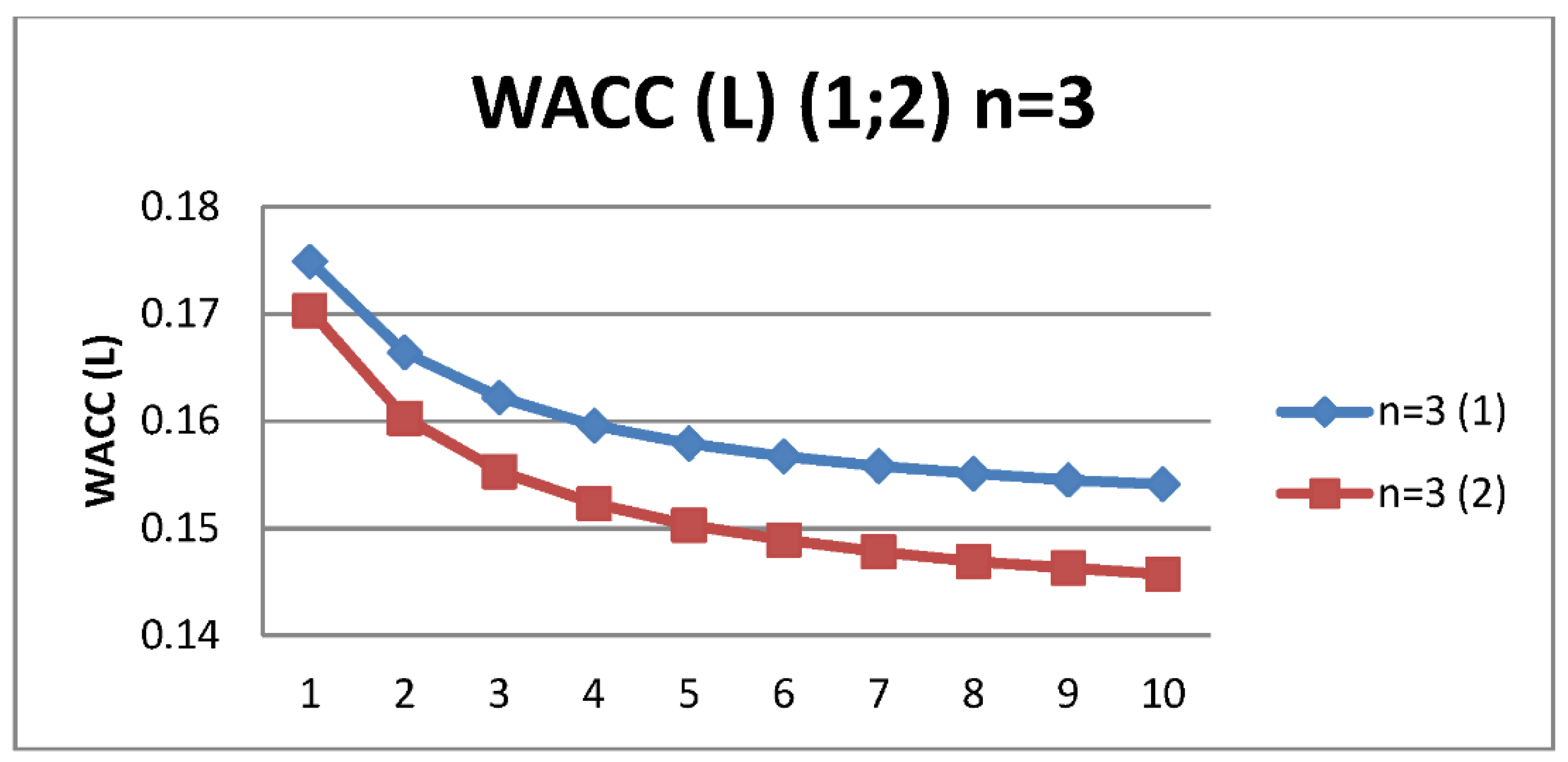

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Definition Formula Example Calculation Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Mathematics Free Full Text Benefits Of Advance Payments Of Tax On Profit Consideration Within The Brusov Ndash Filatova Ndash Orekhova Bfo Theory Html

Solved Total Pv Of Cca Tax Shield For Assuming Asset Is Held In Perpetuity Adjusted With One Half Year Rule Pv Of The Lost Tax Shield Pv Of Cca Tax Course Hero

The Tax Shield Approach Assuming That The Capital Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Chapter 13 Leverage And Capital Structure Ppt Download